The market rose 21% in 5 days!

The transaction volume of A-shares has surged fourfold!

Over 700 stocks hit the daily limit up!

The volatility of the stock market,

Every time it always makes people's hearts surge,

But scammers are also restless,

Get ready to 'cut chives'!

Does the stock recommendation 'teacher' recommend 'high-quality stocks'?

Is the high return result exciting?

be vigilant! Pie won't fall from the sky!

The investment and financial management of 'guaranteed profits without losses' are all scams!

1、 Real case studies

Sun received a friend request from a self proclaimed anchor while watching a live stream of stock trading knowledge on a certain live streaming platform. After a private chat, he was pulled into a stock trading group.

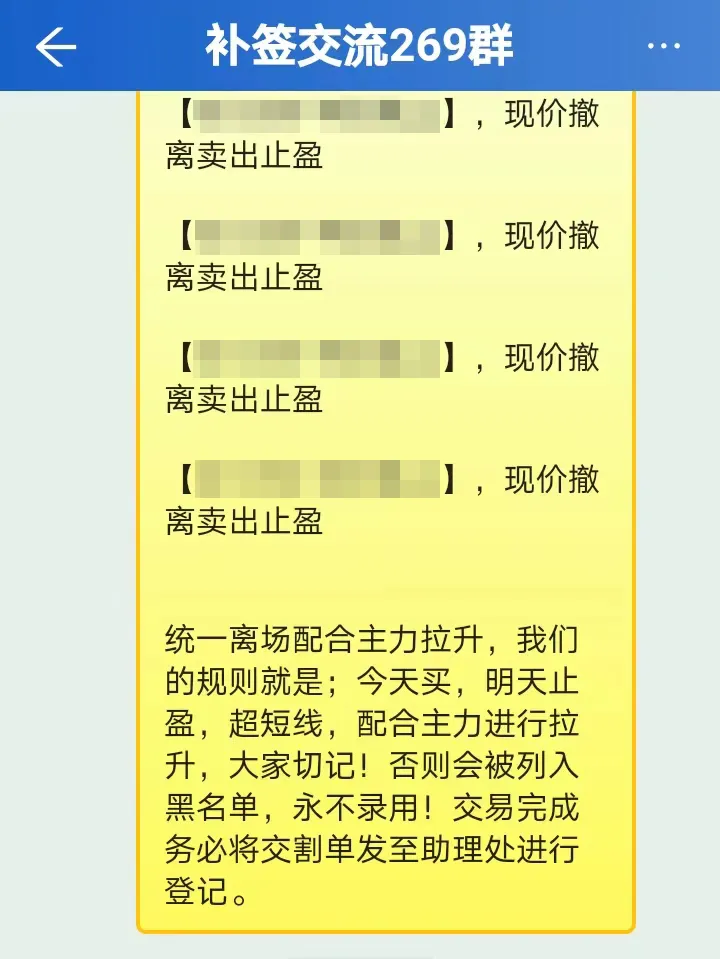

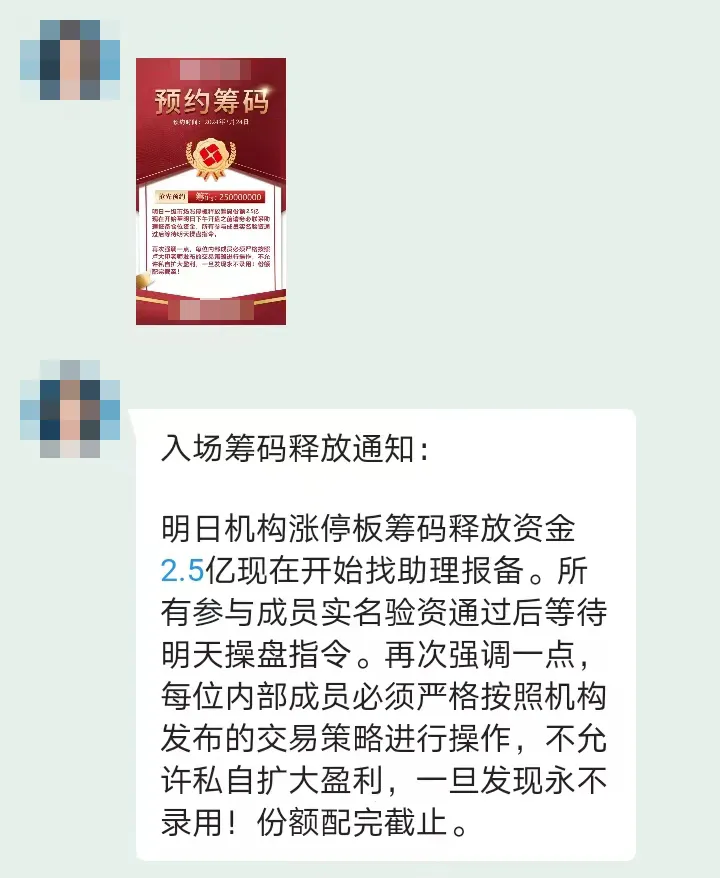

A user nicknamed "Senior Investment Director" in the group often analyzes market trends and recommends stocks. There are also users who claim to be "assistants" who frequently post screenshots of the "director" helping investors make money. Many group members also claim to be beneficiaries. This moved Sun, who had been "diving" for a long time, and he added "director" as a friend.

The "director" said that now, in order to give back to users, they can take everyone to invest in stocks for free. As long as the funds are transferred to the designated APP and operated according to instructions, it is guaranteed that there will be absolutely no losses. Upon hearing this, Sun was thrilled and downloaded the app recommended by the "director", and followed his guidance to conduct investment operations within the app. At the beginning, Sun made several small investment attempts with good returns and successfully withdrew funds, which made Sun feel that this was an opportunity to make big money, so he increased his investment in the app.

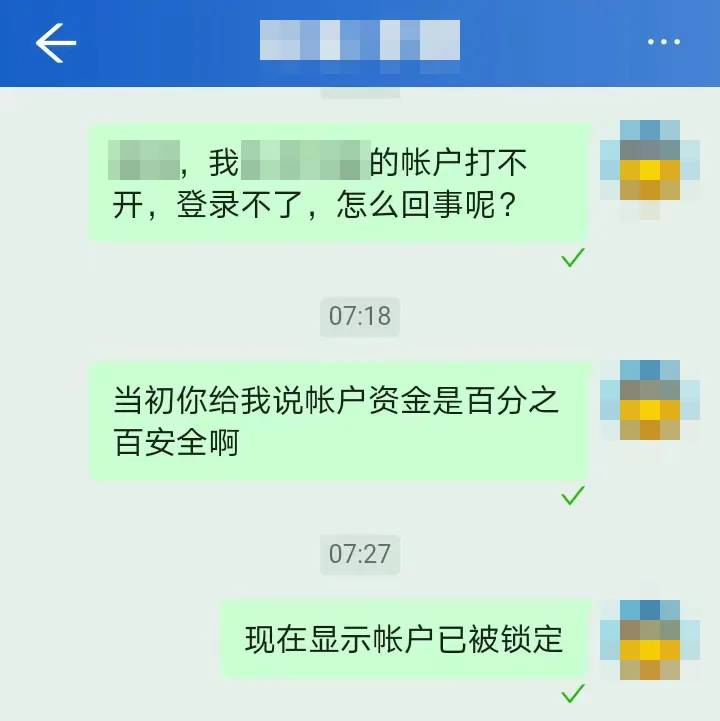

It wasn't until the end of the month that Sun realized he had been scammed when he realized that the balance in the app couldn't be withdrawn.

Fraudsters promote their ability to accurately predict stock prices, create a professional and reliable investment and financial atmosphere, and make people who do not understand investment believe it. They use high profits as bait to induce users to download software for investment and trading.

In the early stages, users were offered the sweetness of high returns, tempting victims to increase their investment. However, in reality, these trading systems and records were all forged. When victims wanted to withdraw, they would encounter situations such as "system crashes" and "inability to withdraw". At this point, they realized that they had been deceived but had lost all their money.

So how to identify investment and financial fraud traps?

These three points must be kept in mind!

2. Quickly identify investment and wealth management fraud

Where did you see the advertisement?

The fraudsters will put a large number of advertisements on various social platforms, WeChat groups, friend circles, and online search engines, and claim to master various investment skills and insider information in the comment areas of Weibo, Tiktok, Zhihu and other apps. More than 80% of victims are friends with scammers on various social media platforms, and are attracted to major fake investment platforms by "money making experience," "financial instructors," and "insider information.

2. How did you download the investment app?

The listing review of financial apps on mobile app stores is very strict, requiring the provision of relevant qualification documents such as business licenses, certificates, agreements, etc. Due to the inability of fraudulent investment and wealth management apps to be listed on the app market through legitimate channels, scammers can only allow users to download and install fraudulent investment and wealth management apps or access fraudulent investment websites by creating website links, sending APK installation packages, or scanning QR codes.

3. What account should I invest in for recharging?

Most fake investment platforms require victims to transfer funds to designated personal accounts or corporate accounts that are not the current investment platform, while legitimate trading platforms can only transfer funds to dedicated corporate accounts opened. At the same time, when purchasing financial products, an investment agreement must be signed, and funds will be automatically deducted. If the other party requests that the transfer can only be made to a personal account or if the requested corporate account does not match the platform name, it is highly likely to be a "black platform" for false investment and wealth management.

III. Conclusion Tip

Stocks are high-risk, please be cautious when investing! Claiming to master various "investment techniques," "insider information," "guaranteed profits," and "low-cost high returns" are all fraudulent rhetoric! Don't believe it easily, don't transfer money. If you are accidentally deceived or encounter suspicious situations, please pay attention to preserving evidence and immediately call 110 to report to the police or 96110 for consultation.

Comprehensive content from Shanghai Anti Fraud Center, Shigatse Anti Fraud Center, Shenyang Public Security New Research Center, Fujian Police